Executive Summary

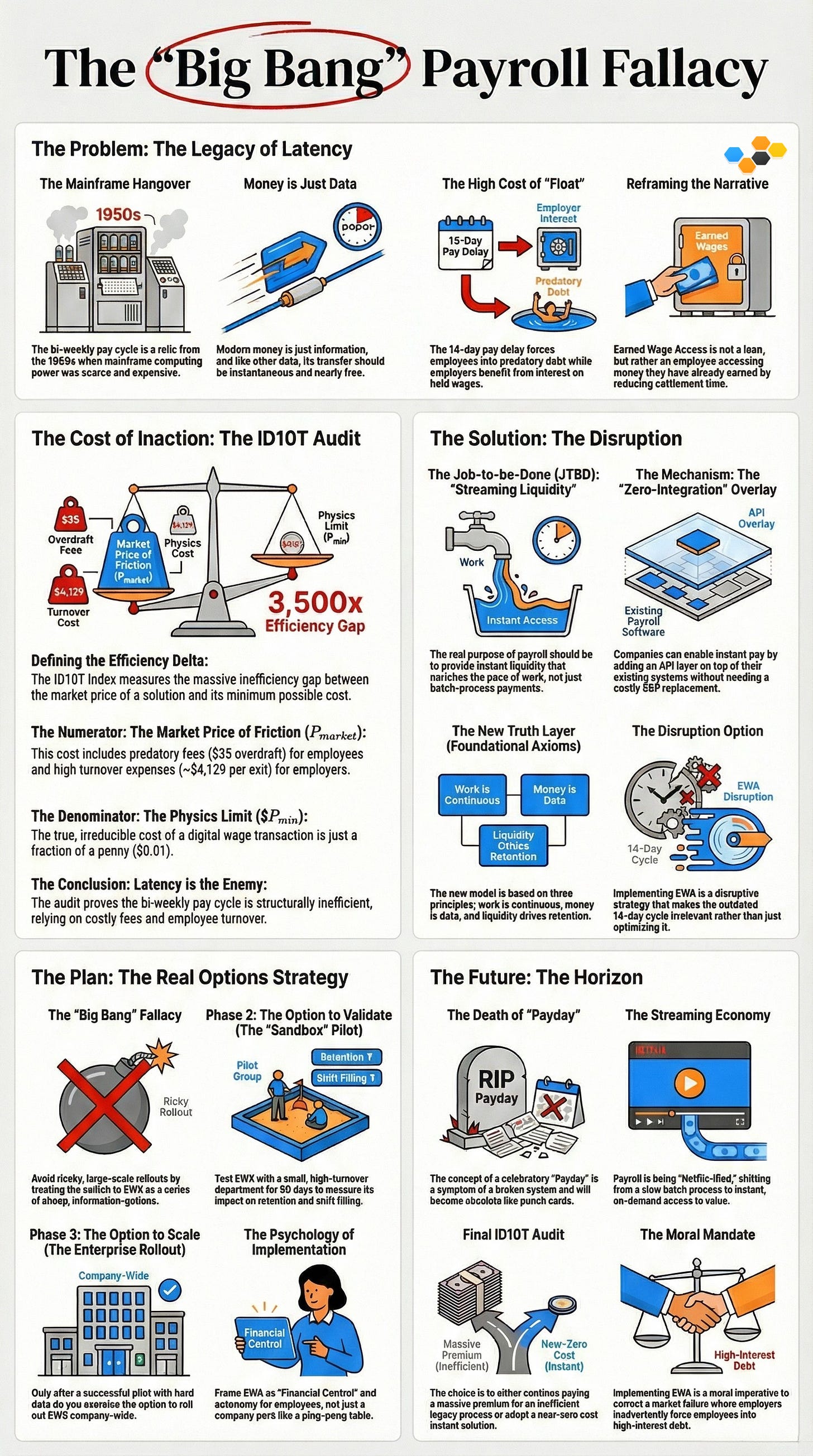

The Problem: The “standard” two-week pay cycle is a relic of 1950s mainframe computing, not a law of economics. This artificial latency forces workers into predatory debt (payday loans, overdrafts) and bleeds employers through massive turnover costs.

The Efficiency Gap: We are paying $35 in overdraft fees or $4,000 in turnover costs to solve a problem that physics says costs $0.01 (a database query).

The Disruption: Stop optimizing “financial wellness” seminars. Delete the latency. Implement Earned Wage Access (EWA) to align compensation speed with work speed.

PART I: THE APEX STRATEGY

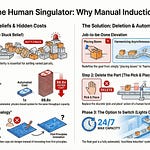

Deconstructing the Stuck Belief

Input Subject: The Bi-Weekly Paycheck (The “Batch Processing” Legacy).

The Stuck Belief: “Employees must be paid in batches because calculating payroll takes time and capital.”

Socratic Inquiry (The Scalpel):

(Clarification): “What exactly prevents real-time payment? Is it a law, or a software limitation?”

(Challenge): “We stream movies, data, and electricity in real-time. Why is money—which is just data—the only utility that lags by 14 days?”

(Implication): “If we delete the 14-day lag, do we delete the need for predatory credit entirely?”

Key Insight: The “Payday” concept is an artifact of physical check printing and manual ledger reconciliation. In a digital API environment, it is purely artificial friction.

The Efficiency Delta

We calculate the cost of this artificial latency using the RFPA Protocol.

Numerator (P_market - The Cost of Friction):

Employee Side: Average Overdraft Fee ($35) or Payday Loan Interest (400% APR).

Employer Side: Replacement cost of an entry-level employee due to financial stress turnover (~$4,129 per hire, per SHRM data).

Denominator (P_min - The Physics Limit):

The Bits Floor: The cost to verify “Hours Worked” and execute a ledger transfer = $0.01 (Digital Transaction Limit).

The Index:

Conclusion: The market is paying a 3,500x premium for “latency” that shouldn’t exist.

Path Selection

Path A (Optimization - Rejected): “Financial Wellness” apps, budgeting workshops, or annual bonuses. (Paving the Cow Path).

Path B (Disruption - Selected): Earned Wage Access (EWA). Streaming liquidity to match labor input.

The Reconstruction (First Principles Solutions)

The Job-to-be-Done (JTBD): “Align cash flow with life flow.”

Foundational Axioms:

Work is Continuous: Value is created every hour, not every 14 days.

Money is Data: Moving it should be instant and frictionless.

Liquidity is Retention: The fastest payer wins the talent war.

The Mechanism:

A “Zero-Integration” overlay that fronts the capital (no cash flow hit to employer).

Automatic reimbursement on “Cycle Day” (no structural change to payroll processing).

Execution Strategy (Real Options)

Option to Explore: Audit the “Turnover Tax.” How many exits cite “better pay” or “financial stress”?

Option to Validate: Pilot EWA with a single department. Measure absenteeism and shift pickup rates.

Option to Scale: Roll out company-wide as a core “Financial Health” benefit, replacing costly recruitment drives.

PART II: THE DECONSTRUCTION

The Legacy of Latency

Chapter TL;DR: We treat the “bi-weekly paycheck” as an immutable economic law, but it’s actually a technical scar from the 1950s. Modern banking APIs can move money in milliseconds ($0.01 cost), yet we force employees to wait 336 hours (14 days) to access wages they’ve already earned.

The Mainframe Hangover

The bi-weekly pay cycle is not a business requirement; it’s a fossilized software limitation. In the 1950s and 60s, calculating payroll was a massive computational event. Companies ran mainframes (like the IBM 1401) that required physical punch cards and hours of dedicated processing time. It was computationally expensive to run these “batches.”

The Constraint: You couldn’t run the payroll “job” every day because the computer time was too valuable and the manual reconciliation took too long.

The Artifact: To save processing power, companies spaced payments out to every two weeks (or monthly).

The Reality Today: We carry this “batch processing” mentality into a world of cloud computing where computing power is effectively infinite and free. We aren’t limited by punch cards anymore, but we still pay people as if we are.

Money is Just Data

If we apply Socratic Inquiry to the nature of money today, we hit a fundamental truth: Money is information.

When you stream a movie on Netflix, you don’t wait 14 days for the data to buffer. You get it the second you request it. Why? Because the cost of transmitting that data is negligible. Wage transfer is identical. It is simply a ledger entry moving from Employer_Account to Employee_Account.

The Physics of the Transaction: The actual cost to update a database row (which is what a bank transfer is) is fractions of a penny.

The Artificial Friction: The 14-day delay is purely artificial. It’s an administrative choice to hold capital that strictly belongs to the worker. As noted in Real Options Logic, value is created the moment the work is performed. Holding that value back creates a “Liquidity Gap” that forces the employee to seek expensive bridge capital.

The High Cost of “Float”

This latency creates a massive ID10T Index gap. By holding wages for two weeks, employers (and their banks) benefit from the “float”—interest earned on money that has technically already been earned by the worker.

The Employee’s Reality: Because they can’t access their liquidity, 72% of Americans live paycheck to paycheck. When an unexpected bill hits on Day 10 of the pay cycle, they have a solvency crisis, despite being “solvent” on paper (accrued wages).

The Predatory Bridge: To bridge this 4-day gap, they turn to overdrafts ($35 fee) or payday loans (400% APR).

The Efficiency Delta:

Cost of Real-Time Access: ~$0.01 - $0.50 per transaction via modern rails (RTP/FedNow).

Cost of Waiting: $35.00 (Overdraft Fee).

The Gap: We are paying a 3,500% premium for a delay that serves no functional purpose.

Reframing the Narrative

We need to stop calling EWA a “loan.” This is a critical semantic shift.

A Loan: Money you haven’t earned yet, given against future promise.

EWA: Money you have earned, accessed when you need it.

When an employee accesses their earned wages, they are simply reducing the settlement time of a transaction that has already occurred. The labor is delivered; the debt is owed. EWA just clears the ledger.

The ID10T Audit (The Cost of Inaction)

Chapter TL;DR: The market price for bridging the 14-day pay gap is roughly $35 (an overdraft fee), while the actual cost to move the money instantly is $0.01. We accept massive financial penalties as the “cost of doing business,” but this is an unforced error.

Defining the Efficiency Delta

To understand why the 14-day pay cycle is obsolete, we can’t just rely on sentiment; we need to use the ID10T Index. This formula calculates the gap between what the market currently pays to solve a problem (P_market) and the theoretical minimum cost defined by physics (P_min).

In the context of payroll, “P” represents the cost of accessing liquidity.

The Numerator: The Market Price of Friction (P_market)

The “Market Price” is the penalty paid by the system because the money is stuck in a 14-day buffer. This cost hits both the employee and the employer.

The Employee Penalty (The Predatory Tax):

When an employee runs out of cash on Day 10, they don’t stop consuming electricity or needing food. They hit a liquidity wall. The market solution is a $35.00 overdraft fee or a payday loan with 400% APR.The Cost: $35.00 per incident.

The Employer Penalty (The Turnover Tax):

Financial stress is the number one driver of employee turnover. When an employee quits to get a signing bonus elsewhere just to pay a bill, the employer pays a replacement cost. According to SHRM data, the cost to replace an entry-level employee is roughly $4,129.The Cost: $4,129 per exit.

The Denominator: The Physics Limit (P_min)

Now, let’s look at the “Physics Limit.” What is the absolute irreducible cost to move the money?

Since money is data, the cost is the energy required to flip a bit in a ledger and the marginal cost of the bandwidth to transmit that confirmation.

The Bits Floor: In a modern API environment (like the FedNow rail or a closed-loop ledger), the marginal cost of a transaction approaches zero.

The Regulatory Floor: Even adding compliance checks, the cost is negligible.

The Physics Limit: $0.01 (1 cent).

The Calculation: A 3,500x Efficiency Gap

If we compare the common “Overdraft Solution” to the “Real-Time Solution,” the math is staggering.

We are paying a 3,500x premium for latency.

If you bought a gallon of gas for $3.50, and the gas station charged you a $3,500 “delivery fee” to pump it into your car 14 days later, you would riot. Yet, this is exactly how the bi-weekly pay cycle operates. We’re burning capital on fees that purchase absolutely no value—they only purchase access to value that already exists.

The Conclusion: Latency is the Enemy

The ID10T Audit proves that the bi-weekly pay cycle isn’t just “old school”; it’s structurally insolvent. It relies on employees paying a “poverty premium” to banks (via overdrafts) or employers paying a “turnover tax” to recruiters. Eliminating the lag isn’t a perk. It’s an efficiency mandate.

PART III: THE RECONSTRUCTION

The Disruption (Aligning Cash Flow with Work Flow)

Chapter TL;DR: The traditional payroll job (”Batch Processing”) solves the wrong problem. We need to delete the concept of “Payday” and replace it with “Streaming Liquidity.” By overlaying a real-time ledger on top of legacy systems, we align cash flow with workflow.

The Job-to-be-Done (JTBD): “Streaming Liquidity”

To fix the payroll system, we first need to redefine its purpose. Using the JTBD Framework, we see that “running payroll” is a process, not an outcome.

Old Job Statement: “Calculate and distribute wages every 14 days to ensure tax compliance and ledger accuracy.”

New Job Statement: “Provide friction-free liquidity that matches the velocity of value creation.”

When an employee works an hour, they have created value. The “Job” of the payroll system is to reflect that value creation in the employee’s wallet instantly. Any delay is a system failure. We aren’t “loaning” them money; we are simply reducing the latency of the settlement.

The Mechanism: The “Zero-Integration” Overlay

The reason companies haven’t switched to daily pay is the “Switching Cost” fallacy. They believe they need to rip out their massive, complex ERP systems (Workday, ADP, SAP) to enable this.

First Principles Deconstruction:

The Myth: “We need to change our payroll software to pay faster.”

The Reality: You just need an API layer that sits on top of the slow software.

The Solution Architecture:

The Shadow Ledger: The EWA provider reads the time-and-attendance data (e.g., “John clocked out at 5:00 PM”).

The Liquidity Bridge: The provider fronts the capital to the employee instantly via the ACH/RTP rail.

The Reconciliation: On the standard “Payday,” the provider is reimbursed automatically. The employer’s massive, slow mainframe doesn’t even know the daily transaction happened until the end.

This is Innovation by Subtraction. We aren’t adding a new payroll process; we are deleting the waiting period by decoupling the payment from the payroll run.

The New Truth Layer (Foundational Axioms)

To build this future, we need to operate on three new axioms that replace the old beliefs.

Axiom 1: Work is Continuous.

Value isn’t created in two-week batches. It’s created continuously. Therefore, compensation need to be accessible continuously.Axiom 2: Money is Data.

If we can stream 4K video to a phone in a subway tunnel, we can stream a $100 balance update. The cost of moving data is zero. The cost of moving money need to approach the cost of moving data.Axiom 3: Liquidity is Retention.

In a labor market defined by the “Great Resignation” or “Quiet Quitting,” the employer who offers the fastest liquidity wins. Data from Mercer indicates that financial stress accounts for up to 40% of employee turnover. Solving liquidity solves retention.

The Disruption Option

This is the “Disruption Option” in Real Options terms. We are not optimizing the 14-day cycle (Path A). We are making the 14-day cycle irrelevant (Path B).

By implementing EWA, you aren’t just offering a “perk.” You are correcting a market failure where labor is sold on Net-14 terms in a world that demands Net-0 payment.

PART IV: THE EXECUTION

Execution (The Real Options Strategy)

Chapter TL;DR: Companies fear that implementing daily pay will break their accounting systems. The cost of a “Wait and See” approach is continued attrition ($4,129 per exit). We use a Real Options Strategy (Explore, Validate, Scale) to test the hypothesis with zero risk.

The “Big Bang” Fallacy

Most organizations fail at innovation because they attempt a “Big Bang” rollout—spending 18 months planning a massive global launch. This violates the RFPA Protocol (Step 4: Accelerate Cycle Time). Instead of a monolithic project, we treat the move to EWA as a series of Real Options.

An “Option” gives you the right, but not the obligation, to make a future investment. We buy information cheaply today to make expensive decisions safely tomorrow.

Phase 1: The Option to Explore (The Data Audit)

Before deploying any software, we purchase the “Option to Explore.” This costs zero dollars and requires only data analysis.

The Question: “Is financial stress actually driving our turnover?”

The Action: Pull your exit interview data for the last 12 months. Search for keywords: “better pay,” “signing bonus,” “need money now,” “schedule conflict” (often a proxy for working a second gig).

The Benchmark: If >30% of exits are wage-related or occur within the first 90 days (the “Liquidity Danger Zone”), you have a confirmed “Job-to-be-Done” gap.

Phase 2: The Option to Validate (The “Sandbox” Pilot)

Do not roll this out to the entire company. Select a “High-Stress Sandbox”—a specific department or location with the highest turnover and absenteeism.

The Setup: Partner with a “Zero-Integration” EWA provider (e.g., DailyPay, EarnIn, Branch) that requires no ERP surgery.

The Investment: Low ($0 - Setup fees are often waived for pilots).

The Test: Enable EWA for this group for 90 days.

The Success Metrics (KPIs):

Retention Delta: Did turnover drop compared to the control group? (Target: >20% reduction).

Shift Velocity: Did the “Time to Fill Open Shifts” decrease? (Employees often pick up extra shifts specifically to cash out instantly).

Absenteeism: Did unexcused absences drop?

Phase 3: The Option to Scale (The Enterprise Rollout)

Only if Phase 2 proves the hypothesis do you exercise the “Option to Scale.”

The Logic: You aren’t guessing anymore. You have hard data proving that spending $X on EWA saves $10X in recruitment costs.

The Integration: Now you can justify a deeper API integration with your payroll system to automate the reconciliation process fully.

The “Kill” Option: If Phase 2 fails (e.g., employees didn’t use it, or turnover didn’t budge), you exercise the “Option to Abandon.” You turn off the pilot. You lost nothing but time.

The Psychology of Implementation

A critical warning: Do not market this as a “Perk.”

If you call it a “Perk,” it sounds like a ping-pong table. Market it as “Financial Control.”

Weak: “We offer early wage access.”

Strong: “We align your pay with your work. You earned it, you control it.” 👈

By framing it as autonomy, you trigger a deeper psychological connection with the workforce. You aren’t just a payer; you are a partner in their financial stability.

PART V: THE HORIZON

Future of Compensation

Chapter TL;DR: “Payday” is a cultural artifact of the batch processing era. We are moving to a “Streaming Economy” where value exchange is instant. The companies that delete the latency will win the talent war.

The Death of “Payday”

For the last century, “Payday” has been a cultural institution. It’s viewed as a celebration—a moment of relief. But under the Socratic Scalpel, we realize that this “relief” is actually a symptom of a broken system. You only feel relief if you were previously in distress.

“Payday” is an artifact of the Batch Processing Era. It belongs in the same museum as the IBM punch card and the physical movie rental store.

The Streaming Economy

We are witnessing the “Netflix-ification” of payroll. In the media industry, the “Job-to-be-Done” shifted from “Owning a DVD” to “Streaming Entertainment.” The friction of the physical disc was deleted.

In the labor market, the friction of the 14-day hold is being deleted.

Money is Data: If you can stream 4K video to a pocket device, you can stream a ledger entry.

Latency is Cost: Every hour of delay adds cost to the system (Overdrafts for employees, Turnover for employers).

Final ID10T Audit

Let’s look at the numbers one last time.

The Market Price of Status Quo: $35.00 per incident (employee fee) + $4,129 per exit (employer cost).

The Physics Limit: $0.01 per transaction.

The Decision: Do you continue to pay a 3,500x premium for a legacy process, or do you adopt the physics-limit solution?

The Moral Mandate

Beyond the economics, there’s a moral dimension to this innovation. By withholding earned wages, employers are inadvertently acting as “negative banks”—holding their employees’ capital at 0% interest while forcing those same employees to borrow it back at 400% APR.

Implementing Earned Wage Access isn’t just about retention metrics or recruiting stats. It’s about correcting a market failure. It’s about ensuring that the value created by a human being is recognized and rewarded at the speed of the digital world we live in.

The future isn’t monthly. It isn’t bi-weekly. The future is Now.

If you find my writing thought-provoking, please give it a thumbs up and/or share it. If you think I might be interesting to work with, here’s my contact information (my availability is limited):

Book an appointment: https://pjtbd.com/book-mike

Email me: mike@pjtbd.com

Call me: +1 678-824-2789

Join the community: https://pjtbd.com/join

Follow me on 𝕏: https://x.com/mikeboysen

Articles - jtbd.one - De-Risk Your Next Big Idea

New Masterclass: Principle to Priority

Q: Does your innovation advisor provide a 6-figure pre-analysis before delivering the 6-figure proposal?