Traditional banks are slow and expensive because they rely on outdated, manual systems and middlemen to verify transactions. This creates a massive efficiency gap where banks charge thousands of times more than the actual cost of moving data. The best solution is not to repair this broken system, but to switch to a decentralized model where you control your own assets and keep the profit yourself

See also:

The $126 Billion Heist: A Practical Plan to Abolish Credit Card Fees for Good

The Practical Innovator's Guide to Customer-Centric Growth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Part I: The Deconstruction (Socratic Inquiry)

Introduction: The Scalpel of Inquiry

The modern banking system is not a product of First Principles engineering; it’s a geological sediment of historical accidents, temporary regulatory patches, and technological limitations that ceased to exist twenty years ago. To understand why we’re paying a “Trust Premium” on the movement of data, we need to first dismantle the linguistic and psychological architecture that keeps the system intact.

We employ the Socratic Scalpel—a method of systematic belief deconstruction—to excise the “Stuck Beliefs” that define the status quo. We don’t ask “How do we make banking faster?” (a legacy question). We ask “Why do we believe a bank is necessary to move value?” (a First Principles question).

Note: I’m biased. I’m an ex-OCC bank examiner, financial auditor, and commercial credit risk officer. But, enough about me. 🤓

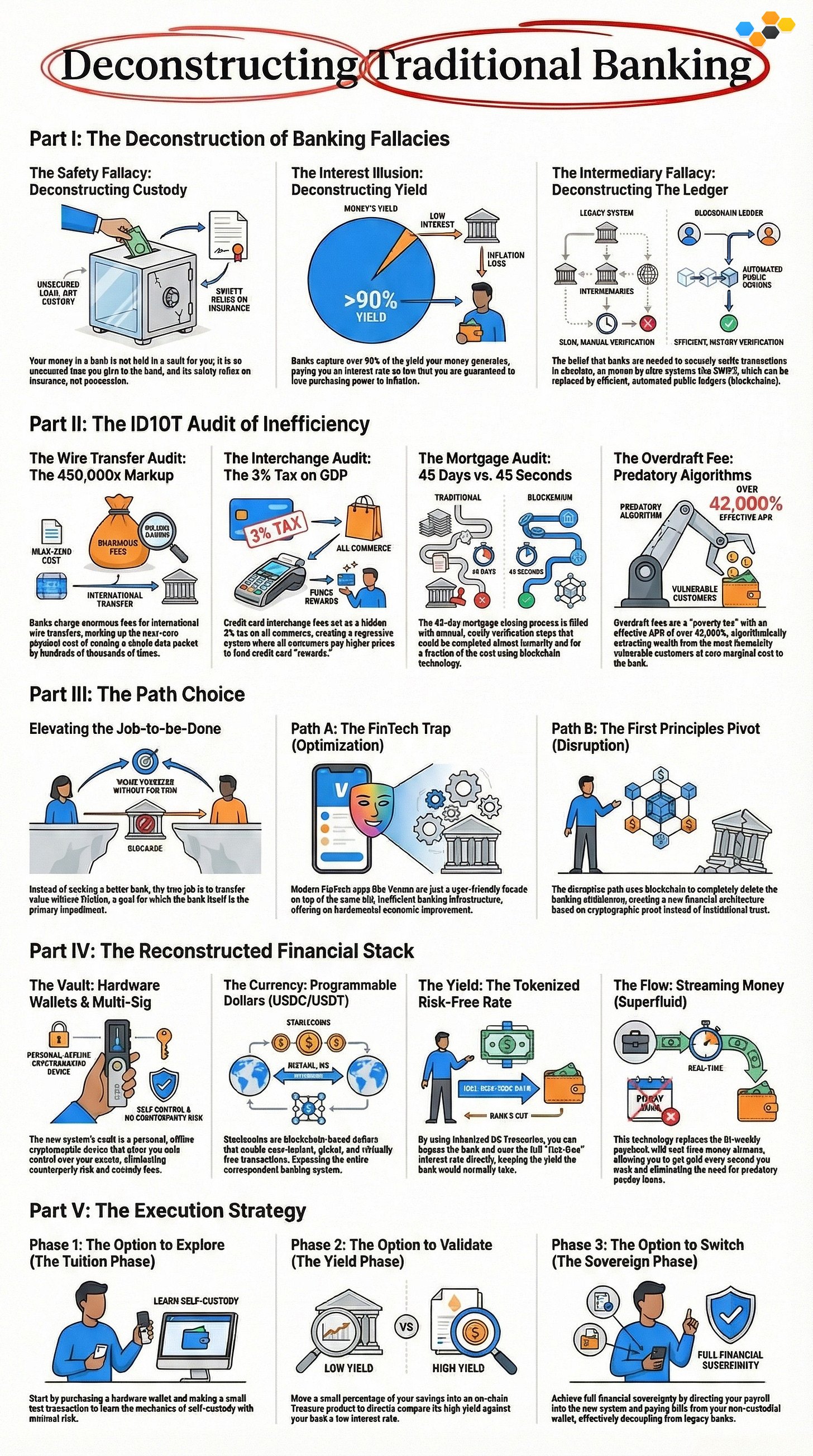

The Safety Fallacy: Deconstructing Custody

Clarification of Terms

What do we truly mean when we say a bank is “safe”?

When the average depositor uses the word “safe,” they’re envisioning a physical or digital vault. They operate under the mental model of bailment—the legal act of entrusting a possession to someone else for safekeeping, with the expectation that the exact same item is waiting for them. If you valet your car, you expect your specific car back, not a generic claim on a fleet of cars that might be lent out to Uber drivers while you eat dinner.

However, the banking system doesn’t operate on bailment; it operates on credit.

Challenging the Core Assumption

The foundational assumption of the retail banking consumer is: “My money is in the bank.”

This is factually incorrect. Once a deposit is made, the money is no longer the property of the depositor. It becomes the property of the bank. The depositor receives an IOU—an unsecured liability of the bank. The bank then lends that capital out (Fractional Reserve Banking) or invests it in long-duration assets (bonds).

We need to challenge the assumption that a “bank deposit” is a form of storage. It is, in first-principles reality, a form of unsecured lending to a highly leveraged hedge fund. The “safety” isn’t derived from the presence of the asset (it’s not there), but from the FDIC insurance limit ($250,000) and the implicit guarantee of the Federal Reserve.

Evidence: The Speed of the Digital Run

The collapse of Silicon Valley Bank (SVB) in 2023 provided the “Hard Anchor” evidence required to shatter the Safety Fallacy.

In the analog era, a bank run was limited by physics—specifically, the friction of human bodies moving in physical space. People had to drive to a branch, stand in line, and fill out paper withdrawal slips. This friction gave regulators time to intervene.

In the digital era, “safety” evaporated in milliseconds. SVB lost $42 billion in 24 hours. That’s a rate of roughly $500,000 per second. The “Run” was not a panic; it was a rational flight to safety executed via mobile APIs. The evidence is clear: In a fractional reserve system where information travels at light speed, no bank is mathematically safe from a liquidity crisis if confidence wavers. The “Safety” is a regulatory illusion, not a mathematical certainty.

Alternative Viewpoints: The Sovereign Vault

If “Safety” equals “Possession,” then the bank is the least safe place for capital.

The alternative viewpoint, grounded in cryptographic First Principles, is Self-Custody. In a self-custodial architecture (e.g., a hardware wallet), the user holds the private keys. The asset exists on a decentralized ledger, not in a corporate database.

Bank Model: You have a claim on a liability. (Counterparty Risk).

Crypto Model: You have possession of the asset. (Bearer Asset).

The banking industry argues that self-custody is “unsafe” because users might lose their keys. This is a “User Interface” problem, not a “System Architecture” problem. It’s easier to build a recoverability layer for keys than it is to fix the solvency risk of a leveraged bank.

The Interest Illusion: Deconstructing Yield

Clarification of Terms

What is “Interest”?

In First Principles economics, interest is the Time Value of Money. It’s the compensation paid to the owner of capital for the opportunity cost of not using that capital for a specific period. It’s the “Risk-Free Rate” set by the laws of supply and demand for sovereign debt (e.g., US Treasuries).

Challenging the Core Assumption

The Stuck Belief here is: “The bank pays me interest as a reward for saving.”

We need to invert this. The bank doesn’t pay you; you pay the bank. The average national savings rate is approximately 0.46% (as of mid-2024). The Federal Funds Rate (the Risk-Free Rate) hovers near 5.33%.

Where’s the missing 4.87%?

It’s captured by the bank as the Net Interest Margin (NIM). The consumer assumes this spread is the “cost of doing business.” We challenge this: Why is the cost of updating a database entry (crediting interest) worth 90% of the yield generated by the asset?

Evidence: The Wealth Erosion Machine

Let us apply the Real Rates Audit.

Inflation (CPI): ~3.0% (Official) / ~5-7% (Real Assets).

Bank Savings Yield: 0.46%.

Real Return: -2.54%. 👈

By holding money in a traditional bank “Savings” account, the user is guaranteeing a mathematical loss of purchasing power. The bank takes the deposit, buys a Treasury Bill yielding 5.3%, gives the depositor 0.4%, and uses the difference to pay for branch real estate, marble lobbies, legacy mainframe maintenance (COBOL), and executive compensation.

The “Interest” paid by banks is not a yield; it’s a customer acquisition cost that is intentionally priced below the rate of inflation to subsidize the bank’s inefficient cost structure.

Implications

If the consumer understood that they could buy the exact same asset the bank buys (US Treasuries) directly via a brokerage or an on-chain tokenized T-Bill (e.g., BUIDL/OUSG) and keep 99% of the yield, the retail banking deposit base would collapse. The system relies on Information Asymmetry—the customer’s ignorance of the Risk-Free Rate—to maintain its margins.

The Intermediary Fallacy: Deconstructing The Ledger

Clarification of Terms

What is a “Bank,” fundamentally?

Strip away the branding, the lobbies, and the credit cards. A bank is fundamentally a Private Ledger Keeper. Its primary job is to maintain a database of who owns what and to ensure that if Alice sends $50 to Bob, Alice is debited and Bob is credited.

Challenging the Core Assumption

The core assumption is: “We need a Trusted Third Party to prevent the Double-Spend Problem.”

This was true for 5,000 years of human history. Physical cash can’t be double-spent (once I hand it to you, I don’t have it). Digital cash, prior to 2009, required a central authority (Visa, The Fed, The Bank) to verify that I didn’t send the same digital dollar to two people.

The “Stuck Belief” is that Centralization is the only path to Verification.

Evidence: The SWIFT Delay

The SWIFT network (Society for Worldwide Interbank Financial Telecommunication) is the physical manifestation of the Intermediary Fallacy.

When money moves internationally, it doesn’t “move.” Messages move. Bank A sends a message to Bank B, which sends a message to Bank C. Each bank updates its own private ledger. Because these ledgers are siloed and proprietary, they must be manually or batch-reconciled. This takes T+2 days.

Physics Limit: Light travels around the Earth 7.5 times in one second.

Banking Limit: Money travels across the Atlantic in 2 days.

The ID10T Index (Inefficiency Delta) of the SWIFT network is astronomical. The delay isn’t technical; it is structural. It’s the time required for humans and legacy scripts to agree on the state of truth across disconnected databases.

Implications

Satoshi Nakamoto’s 2008 whitepaper was not just about “Bitcoin”; it was a proof-of-concept for Triple-Entry Bookkeeping.

Single-Entry: I write in my book.

Double-Entry: I write in my book, you write in yours (Banking).

Triple-Entry: We both write to a shared, immutable public ledger (Blockchain).

In a Triple-Entry system, Reconciliation is automated by the protocol. The “Trusted Third Party” is replaced by “Cryptographic Proof.” The cost of verification collapses from the salary of a compliance department to the cost of a transaction hash (cents).

If the ledger is public and mathematically verifiable, the “Bank” as a Keeper of Truth becomes obsolete. It’s deleted from the process flow.

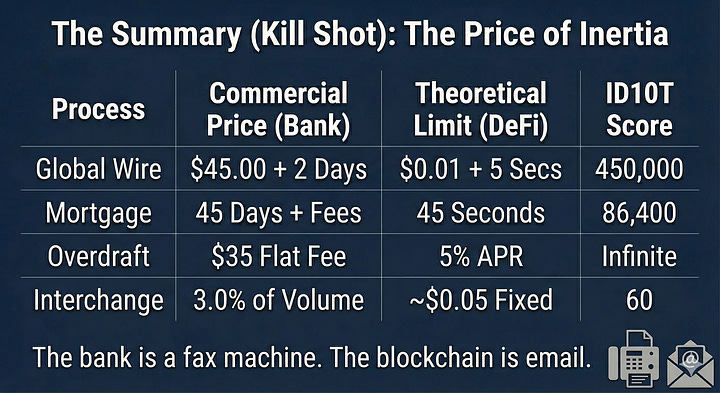

Part II: The ID10T Audit (The Efficiency Delta)

Introduction: The Price of Inertia

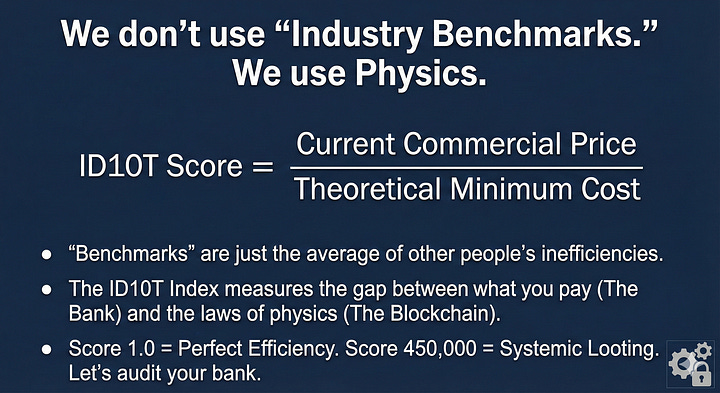

In the Robust First Principles Analyst (RFPA) Protocol, we don’t rely on “Industry Benchmarks.” Benchmarks are merely the average of other people’s inefficiencies. Instead, we use the ID10T Index (Inefficiency Delta in Operational Transformation).

The Index measures the gap between the Current Commercial Price (what you pay) and the Theoretical Minimum Cost (the limit of physics and automation).

A score of 1.0 is perfect efficiency. A score of 10.0 implies 90% waste. As we will demonstrate, the Global Banking Sector operates with ID10T scores ranging from 300 to 450,000. This is not “overhead”; it is systematic looting of the productive economy.

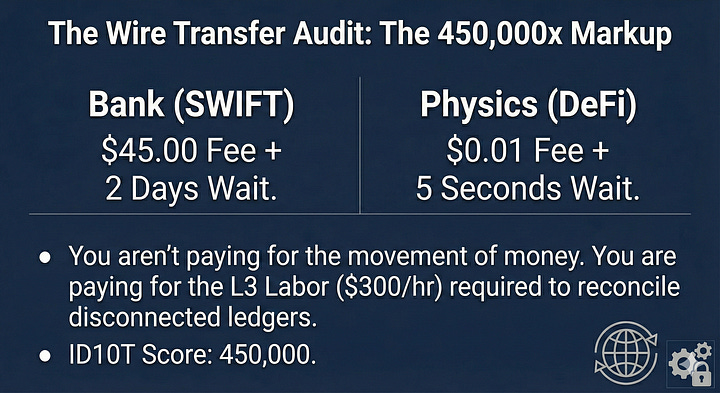

The Wire Transfer Audit: The 450,000x Markup

The Commercial Reality

To send $10,000 from New York to London via the SWIFT network, the typical “Global Systemically Important Bank” (GSIB) charges:

Sender Fee: $45.00

Receiver Fee: $15.00

FX Spread: ~2.0% (Hidden cost on exchange rate = $200.00)

Time: 2 to 5 business days.

Total Cost: ~$260.00 + 3 Days of Liquidity Lock-up.

The Physics Limit (The Bits Floor)

What actually happened physically?

Did a pallet of cash move on a plane? No. A data packet of approximately 2KB was updated on two servers.

Energy Cost: Negligible.

Compute Cost: <$0.0001.

Bandwidth Cost: Negligible.

Verification Cost: In a decentralized system (e.g., Solana or Layer 2 Ethereum), the cost to validate a signature and update the state is currently ~$0.0006 to $0.05.

Let’s be charitable and set the Theoretical Minimum Cost at $0.01 (The “Bits Floor” for a verified transaction).

The ID10T Calculation

Numerator: $45.00 (Fee only, excluding FX theft).

Denominator: $0.0001 (Physics limit of data transmission).

Adjusted Denominator: $0.01 (Blockchain gas fee floor).

If we include the FX spread ($200), the score jumps to 24,500.

The bank is charging a 2,450,000% markup on the movement of a database entry.

Root Cause Analysis

Why does this exist?

It exists because SWIFT messages are not self-settling. They’re just “chat messages” between banks. The actual settlement requires Correspondent Banking relationships—a chain of L3 and L4 labor (Compliance Officers, Treasury Managers) who must manually intervene if a message fails formatting (exception handling). You aren’t paying for the wire; you’re paying for the L3 Labor ($300/hr) required to maintain the legacy “Trust” network.

The Interchange Audit: The 3% Tax on GDP

The Commercial Reality

Every time a consumer swipes a credit card, the merchant loses 2.5% to 3.5% of the revenue to the “Interchange” fee. This fee is split between the Issuing Bank, the Acquiring Bank, and the Network (Visa/Mastercard).

The Physics Limit

A credit card transaction is a simple ledger update:

Debit Customer A -> Credit Merchant B.

Risk Cost: Fraud detection (Algorithm).

Settlement Cost: Database update.

In a peer-to-peer digital cash system (First Principles), the cost of transfer is independent of the amount transferred. Sending $1,000,000 costs the same compute as sending $1.00.

However, the “Interchange” model is a percentage-based tax. It defies the physics of computing. It costs the network no more energy to process a $10,000 transaction than a $10 transaction, yet the fee scales linearly ($300 vs $0.30).

The “Points” Ponzi Scheme

Why do consumers tolerate this? Because of the “Rewards” loop. The bank charges the merchant 3%. The merchant raises prices by 3% to compensate. The bank gives the consumer 1.5% back in “Points.”

The consumer feels like they are “winning,” but they’re actually paying higher prices to subsidize a middleman that harvests the 1.5% spread. This is a Regressive Tax on cash users (who pay the higher prices but get no points) transferring wealth to credit users.

The Efficiency Delta

Current Price: 3.0% of Gross Transaction Volume (GTV).

Theoretical Minimum: Fixed fee of ~$0.05 per transaction (USDC on-chain transfer).

Impact: On a $100 transaction, the fee is $3.00. The limit is $0.05.

ID10T Score: 60.

While lower than the Wire Transfer score, the aggregate volume makes this the single largest rent-seeking mechanism in the global economy. It’s a persistent drag on GDP.

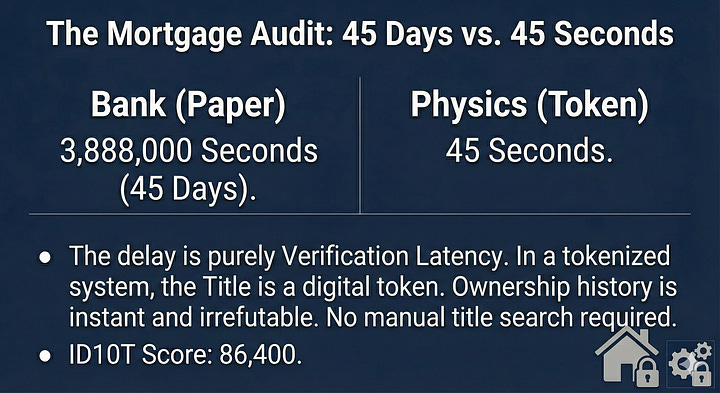

The Mortgage Audit: 45 Days vs. 45 Seconds

The Commercial Reality

Closing a mortgage in the US takes 30 to 45 days.

Closing Costs: 2% - 5% of loan value ($10,000+).

Title Insurance: $1,000 - $3,000.

Appraisal: $500+.

The Physics Limit

What's a mortgage? It’s a contract where an asset (House) is used as collateral for a stream of payments (Loan).

Information Travel Time: Speed of light.

Verification Time: ~1 second (Digital Signature).

Why 45 days?

The delay is purely Verification Latency.

Title Search: A human (L2 Labor, $75/hr) must dig through county clerk records to ensure no one else owns the house.

Underwriting: A human (L3 Labor, $300/hr) must verify PDF bank statements to ensure the borrower has income.

Appraisal: A human (L3 Labor) must drive to the house to guess its value.

The “Coase Limit” Violation

Ronald Coase (Nobel Prize) argued that firms exist to minimize transaction costs. The modern mortgage industry maximizes them.

In a Tokenized Real World Asset (RWA) system:

Title: The deed is a token on a blockchain. Ownership history is instant and irrefutable. (Time: 0s).

Income: Verified via “Open Banking” APIs or streaming payroll. (Time: 0s).

Collateralization: A smart contract locks the Title Token as collateral for the Loan USDC.

Theoretical Minimum Cycle Time: 45 Seconds.

Current Cycle Time: 3,888,000 Seconds (45 Days).

ID10T Score: 86,400.

2.4 The Overdraft Fee: Predatory Algorithms

The Commercial Reality

The average Overdraft Fee is $35.00.

This fee is triggered when a user attempts to spend $50 but only has $40. The bank covers the $10 gap and charges $35.

APR Calculation: Lending $10 for 3 days at a cost of $35 is an Annualized Percentage Rate (APR) of 42,500%. 👈 (feel stupid yet?)

The Physics Limit

The cost to the bank to “decide” to cover the transaction is the cost of an IF/THEN statement in their mainframe code.

IF account_balance < transaction_amt AND overdraft_protection = TRUE THEN approve_transaction.Marginal Cost: $0.00.

The Analysis

This is not a “Service Fee.” It’s a Poverty Tax.

The bank effectively uses an automated algorithm to target its most vulnerable customers (those with low balances) and extracts L1 Labor wages (3 hours of work at minimum wage) for a service that cost the bank 0 bits of extra effort.

In a DeFi (Decentralized Finance) environment, an “Overdraft” is simply a collateralized loan. If you have collateral, you borrow against it at market rates (e.g., 5% APR). If you don’t, the transaction fails. There is no concept of a punitive $35 administrative fee because there is no administrator to pay.

Part II Conclusion

The ID10T Audit reveals that the banking sector is not selling “Money Storage” or “Transaction Services.” They are selling Latency and Inefficiency.

They create latency (T+2 settlement) and charge you to speed it up (Wire Fees).

They create opacity (Hidden FX spreads) and charge you for convenience.

They create complexity (Manual Title Search) and charge you for “Closing Costs.”

The gap between the Current Price ($45 Wire) and the Physics Limit ($0.01 Packet) is the Profit Margin of the status quo. Innovation doesn’t mean “lowering the wire fee to $40.” Innovation means “deleting the wire.”

Part III: The Path Choice (JTBD Elevation)

Introduction: Fixing the Horse vs. Building the Engine

When an industry faces a “Physics-Limit” crisis (like an ID10T Score of 450,000), there are only two ways to respond.

Optimization (Path A): You accept the constraints of the legacy system and try to make it slightly faster or prettier. You feed the horse better oats (FinTech).

Disruption (Path B): You reject the constraints, delete the legacy components, and build a new architecture from First Principles. You build the internal combustion engine (DeFi).

To choose the correct path, we need to elevate the Job-to-be-Done (JTBD). We must stop defining the job in terms of the solution (”I need to wire money”) and define it in terms of the outcome (”I need to transfer value”).

Question: I wonder what Elon Musk is working on right now?

Elevating the Job-to-be-Done

Level 1: The Functional Job (Status Quo)

Definition: “Securely store my US Dollars and pay bills.”

The Trap: This definition locks you into the banking paradigm. It assumes “US Dollars” must be stored in a “Bank Account.”

Result: You shop for a bank with a better app or fewer fees.

Level 2: The Abstract Job (Outcome-Focused)

Definition: “Preserve the purchasing power of my labor and transact with others globally.”

The Shift: This removes the “Bank” from the equation. It focuses on purchasing power (fighting inflation) and transaction (mobility).

Result: You begin to look for high-yield assets and global payment rails.

Level 3: The Systemic Job (First Principles)

Definition: “Verify and transfer ownership of value without friction or counterparty risk.”

The Revelation: This definition reveals that the “Bank” is actually an impediment to the job. The bank introduces friction (fees/delays) and counterparty risk (insolvency).

Result: To get the L3 Job done perfectly, you must delete the intermediary.

Path A: The FinTech Trap (Optimization)

The Strategy: “Lipstick on a Pig”

The “FinTech” revolution (Chime, Revolut, PayPal, Venmo) is largely an illusion of innovation. These companies do not move money. They are User Interface Layers built on top of the rotting infrastructure of the 1970s.

Venmo: When you “Venmo” a friend, money does not move. Venmo simply updates an internal spreadsheet. The actual money sits in a pooled bank account at Wells Fargo or JPMorgan. To get the money out, you need to use ACH (1970s rail) or Push-to-Card (Visa rail).

Neobanks (Chime/Monzo): They aren’t banks. They’re marketing front-ends for “White Label” partner banks (e.g., The Bancorp Bank).

The Flaw: Inherited Inefficiency

Because FinTechs are built on top of the legacy stack, they inherit all of its ID10T scores.

They can’t offer 5% yields because the underlying partner bank keeps the NIM.

They can’t settle instantly globally because they rely on SWIFT for cross-border.

Verdict: Path A is Sustaining Innovation. It makes the experience nicer, but it doesn’t change the economics. It optimizes the horse.

Path B: The First Principles Pivot (Disruption)

The Strategy: Delete the Middleman

Path B applies the Musk Loop to the financial stack.

Make Requirements Less Dumb: “Who said we need a bank charter to verify a transaction?” (Answer: No one. Physics only requires a verifiable ledger).

Delete the Part: Delete the “Ledger Keeper” (The Bank). Delete the “Settlement Layer” (The Clearing House).

Simplify: Replace the “Compliance Department” with “Cryptographic Signatures.”

Automate: Replace the “Loan Officer” with a “Smart Contract.”

The Architecture: Self-Sovereign Finance

In this model, the “Bank” is replaced by a protocol (e.g., Ethereum, Solana) and a wallet (e.g., Ledger, Phantom).

Custody: You hold the asset (Private Keys). ID10T Score for Custody Risk = 1.0 (Physics Limit).

Transfer: You sign a message. The network validates it. Cost: $0.01. ID10T Score = 1.0.

Yield: You lend directly to the market or buy Treasuries on-chain. You keep 99% of the yield. ID10T Score = 1.0.

The Trade-off: Responsibility

Path B requires the user to accept Sovereignty.

Old World: If you forget your password, you call the bank. If the bank fails, you call the government.

New World: If you lose your keys, the money is gone.

Analysis: This is the primary friction preventing mass adoption. However, “Smart Wallets” (Account Abstraction) and Biometric recovery are rapidly solving this. The friction of responsibility is cheaper than the cost of rent-seeking.

Part III Conclusion

The choice is binary.

You can choose Path A, where you pay 3% interchange fees and lose 4% to inflation in exchange for a nice mobile app and a customer support phone number.

Or you can choose Path B, where you pay $0.01 for transfers and earn 5% real yield, but you must take responsibility for your own security.

History shows that once the Efficiency Delta (ID10T Gap) becomes wide enough, the market always chooses Path B. The friction of learning a new system is temporary; the cost of rent-seeking is permanent.

You don’t need a job map to see this.

Part IV: The Reconstruction (Physics-Limit Architecture)

Introduction: The New Stack

We’ve deconstructed the “Bank” into its constituent functions: Custody, Transfer, and Yield. We’ve also identified that the inefficiency of the current model is not a bug; it is a feature of the “Trusted Third Party” architecture.

To reconstruct a financial system that operates at the theoretical limit of efficiency (an ID10T score of ~1.0), we need to build a stack where “Trust” is replaced by “Verification.” This isn’t a theoretical exercise. The components of this stack exist today. They are Emergent/Feasible technologies that have passed the “Physics Test.”

The Vault: Hardware Wallets & Multi-Sig

The Concept

In the legacy world, the “Vault” is a physical room or a database row owned by a corporation. In the reconstructed world, the “Vault” is a Cryptographic Signing Device.

The Mechanism

Hardware Wallets (e.g., Ledger, Trezor): These devices store the Private Keys offline (Cold Storage). They’re “Air Gapped,” meaning they never touch the internet. To spend money, you need to physically connect the device and press a button.

Physics Limit: An offline device can’t be hacked remotely. The attack vector is physical theft, which is a solved problem (PIN codes + Passphrases).

Multi-Signature (Multi-Sig): For corporate or family accounts, we use a “M-of-N” scheme. A transaction requires 2 out of 3 signatures (e.g., Husband, Wife, Lawyer) to execute.

Improvement: This replicates the safety of a corporate board resolution but enforces it mathematically rather than legally.

The Efficiency Gain

Custody Fees: $0.00.

Counterparty Risk: 0%. (There is no bank to go bankrupt).

Access: 24/7/365. (No “Banking Hours”).

The Currency: Programmable Dollars (USDC/USDT)

The Concept

We don’t need “Bitcoin” to replace the Dollar to fix banking. We need the Dollar to move like Bitcoin.

Stablecoins (USDC, USDT, PYUSD) are tokenized representations of fiat currency that live on a blockchain.

The Mechanism

A Stablecoin is a “Wrapper.”

Collateral: You deposit $1.00 of fiat into a reserve (e.g., Circle’s bank account or BlackRock’s Treasury Fund).

Minting: The protocol issues 1.00 USDC token to your wallet.

Utility: This token can now move anywhere on the internet in seconds.

Redemption: You can burn the token to receive $1.00 back.

The Efficiency Gain

Settlement Time: <5 Seconds (on Solana/Base/Arbitrum).

Settlement Cost: <$0.01.

Global Reach: A vendor in Nigeria can accept USDC as easily as a vendor in New York. There is no SWIFT, no correspondent banks, and no FX markup.

The Yield: The Tokenized Risk-Free Rate

The Concept

As established in Part I, banks strip 90% of the yield from your capital. In the reconstructed stack, we bypass the bank and lend directly to the Issuer (The US Government).

The Mechanism

Tokenized Treasuries (e.g., BlackRock’s BUIDL, Franklin Templeton’s FOBXX, Ondo Finance’s OUSG).

Process: The fund buys short-term US Treasury Bills. It issues a token representing a share of that fund.

Yield Distribution: The interest (e.g., 5.0%) flows directly into the token value or is air-dropped as additional tokens into your wallet.

Smart Contracts: The distribution is automated. There is no “Net Interest Margin” to pay for branches. The management fee is typically 0.20% - 0.50% (vs. the bank’s ~4.00% spread).

The Result

The user holds a dollar-equivalent asset that automatically grows at the Risk-Free Rate. This restores the “Savings Account” to its true purpose: Wealth Preservation.

The Flow: Streaming Money (Superfluid)

The Concept

Why do we get paid every two weeks?

Because in the 1950s, the “Batch Processing” cost of running payroll on a mainframe was high. We are paid bi-weekly because of a computation constraint that no longer exists.

Time Value of Money dictates that money received now is worth more than money received later.

The Mechanism

Streaming Protocols (e.g., Superfluid, Sablier).

Logic: Instead of sending a lump sum, a Smart Contract opens a “Stream.”

Execution: Money flows from Employer to Employee every second.

Visual: You watch your wallet balance tick up in real-time as you work.

The Efficiency Gain

Liquidity: The employee has instant access to earned capital. This eliminates the need for “Payday Loans” (predatory lending).

Working Capital: Businesses can automate vendor payments to flow only as services are delivered.

Market Reality Check: The Adoption Barrier

The Existence Test

Do these tools exist?

Vault: Yes. Ledger, Trezor, Safe (Multi-sig).

Currency: Yes. $160 Billion+ in Stablecoins in circulation.

Yield: Yes. Over $2 Billion in Tokenized Treasuries on-chain.

The Physics/Materials Test

Is this feasible?

Yes. Public blockchains (Solana, Ethereum L2s) process thousands of transactions per second at negligible cost. The throughput is sufficient to replace VISA.

The Regulatory Floor (The Final Friction)

The only remaining ID10T gap is the On-Ramp/Off-Ramp.

To convert “Old Money” (Bank Dollars) into “New Money” (USDC), you need to pass through a regulated entity (Coinbase, Kraken, Circle). This entity must perform KYC/AML checks (L1/L2 Labor).

Result: You pay a fee (~0.5% - 1.0%) to enter the system.

Strategy: The goal of the Reconstruction is to enter the system once and never leave. If you get paid in USDC and spend in USDC, you never pay the Off-Ramp tax.

Part V: The Execution (Real Options Strategy)

Introduction: The “Overnight Success” Fallacy

Transitioning from the legacy banking system to a Self-Sovereign Financial Stack is not an event; it’s a process. To advocate for “selling everything and buying crypto” is irresponsible and violates the Real Options protocol.

Instead, we treat the transition as the purchase of specific Options—rights, but not obligations, to move capital into the new system as certainty increases and risk decreases. We apply the Staged Investment Process (from A Real Options Approach to Innovation Investment) to personal and corporate finance.

Phase 1: The Option to Explore (The Tuition Phase)

Objective: De-risk the technology. Learn the “User Interface” of sovereignty with capital you can afford to lose.

The Action Plan

Hardware Acquisition: Purchase a cold storage device (Ledger or Trezor). This is your “Vault.” Cost: ~$70.

Liquidity Injection: Open an account at a regulated exchange (Coinbase/Kraken). Purchase $100 of USDC.

The “Hello World” Transaction: Withdraw the USDC to your Hardware Wallet. Then, send $10 to a friend or a second wallet.

The Payoff

You’ve purchased the Option to Explore.

Cost: ~$70 (Device) + ~$2 (Fees).

Value: You’ve verified, through direct experience, that you can move value globally without a bank permission slip. You’ve demystified the “Magic Internet Money.”

Phase 2: The Option to Validate (The Yield Phase)

Objective: Test the economic hypothesis. Verify that the “Risk-Free Rate” can be accessed without the bank’s NIM.

The Action Plan

Allocation: Move 5-10% of your “Emergency Fund” (Cash Savings) into the ecosystem.

Deployment: Deploy this capital into a conservative, on-chain yield instrument.

Accredited Investors: Tokenized Treasuries (BUIDL, OUSG). Yield: ~5.1%.

Retail Investors: Over-collateralized lending markets (e.g., Aave) or transparent stablecoin yield products (e.g., Coinbase USDC Rewards). Yield: ~4% - 8%.

Observation: Monitor the dashboard. Watch the interest accrue in real-time (every block), not monthly.

The Payoff

You’ve purchased the Option to Validate.

Metric: Compare the monthly payout of this 10% allocation to the monthly interest of your entire remaining bank balance.

Result: You’ll likely find that 10% of your capital in the New Stack generates more income than 90% of your capital in the Old Stack. This “Hard Anchor” data validates the decision to expand.

Phase 3: The Option to Switch (The Sovereign Phase)

Objective: Decouple from the legacy system entirely. Treat the bank only as a “dumb pipe” for on-ramping.

The Action Plan

Payroll Integration: Use a service like Bitwage or Spritz Finance to divert a portion of your payroll directly into USDC/BTC/ETH.

Bill Pay: Use crypto-debit cards or bill-pay services to pay mortgage/rent directly from your non-custodial wallet.

Self-Insurance: As your “Sovereign Vault” grows, you become your own insurer. The “safety” of the FDIC is replaced by the “safety” of over-collateralized mathematical certainty.

The Payoff

You’ve now exercised the Option to Switch.

You’re no longer exposed to “Bank Runs.”

You’re no longer losing 4% to inflation + NIM.

You are now globally mobile. Your wealth is in your head (Seed Phrase), not in a jurisdiction.

The Corporate Execution (Treasury Management)

For the CFO, the Real Options logic is even more compelling.

Working Capital: Holding $10M in a bank account yielding 0.5% is a fiduciary failure. Moving it to on-chain Treasuries yielding 5.0% adds $450,000 to the bottom line annually.

Settlement: Paying international vendors via SWIFT (T+2, 2% FX loss) is operational negligence. Paying via USDC (T+5 seconds, $0.01 fee) optimizes the Cash Conversion Cycle.

Corporate Strategy:

Open a corporate account with a qualified custodian (Coinbase Prime / Anchorage).

Purchase Tokenized Treasuries for the balance sheet.

Use stablecoins for all cross-border AP/AR.

Part VI: Conclusion (The Inevitability of Physics)

The Kodak Moment for GSIBs

In 1998, Kodak argued that digital photos were “low quality” and that people valued the “tactile experience” of holding a print. They were technically right, but structurally doomed. They were selling chemistry in a physics world.

Today, Global Systemically Important Banks (GSIBs) argue that crypto is “risky” and people value the “safety” of a branch. They are selling Trust (a chemical state of mind) in a world of Verification (a physical state of computation).

The Final ID10T Summary

We close with the “Hard Anchors” that make the transition inevitable. The ID10T Index is the gravity that pulls the market toward efficiency.

The Call to Action

The era of Rent-Seeking is ending not because of regulation, but because of obsolescence.

The bank is a fax machine. The blockchain is email.

You can continue to pay $45 to send a fax, or you can exercise your option to switch.

The physics are clear. The math is verifiable. The choice is yours.

If you find my writing thought-provoking, please give it a thumbs up and/or share it. If you think I might be interesting to work with, here’s my contact information (my availability is limited):

Book an appointment: https://pjtbd.com/book-mike

Email me: mike@pjtbd.com

Call me: +1 678-824-2789

Join the community: https://pjtbd.com/join

Follow me on 𝕏: https://x.com/mikeboysen

Articles - jtbd.one - De-Risk Your Next Big Idea

New Masterclass: Principle to Priority